By Tyler Durden

"It's All One Big Trade" Tyler Durden Sun, 08/30/2020 - 20:50

Following up on our earlier discussions of the myriad of market abnormalities observed in today's market (here and here), Bank of America's Research Investment Committee has come up with an alternative, somewhat simpler explanation for some of the most patently absurd events seen in markets in more than one generation.

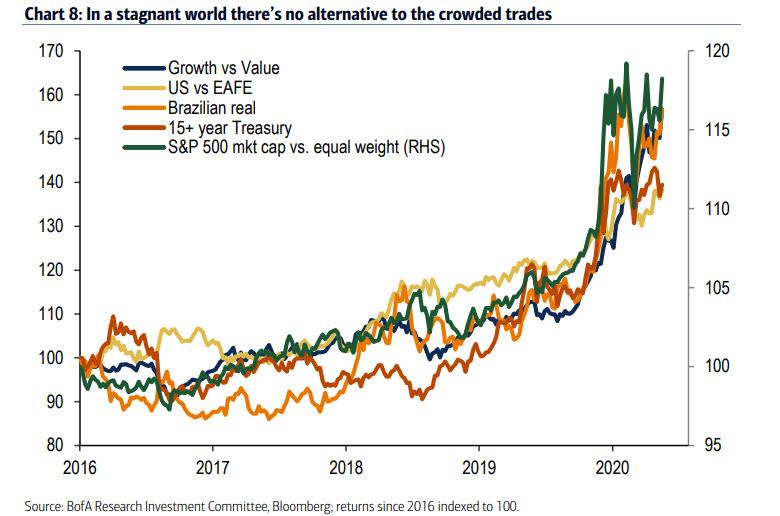

According to BofA's Jared Woodard, the crowded trades – growth vs. value, large vs. small, US vs. EAFE, market cap vs. equal-weight, USD vs. EM FX, Treasury bonds – stay crowded because there is no alternative in a world of shrinking returns on capital.

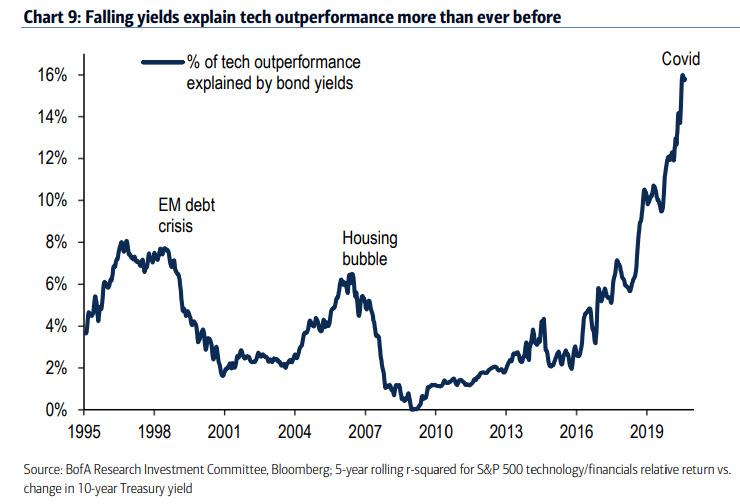

It gets better: BofA contends that in 2020 "Treasuries = tech & Tesla": plunging discount rates & excess liquidity push the value of long-term cash flows toward infinity. That means that, as the chart below shows, bond yields - currently at all time lows - "have never before explained this much of tech returns."

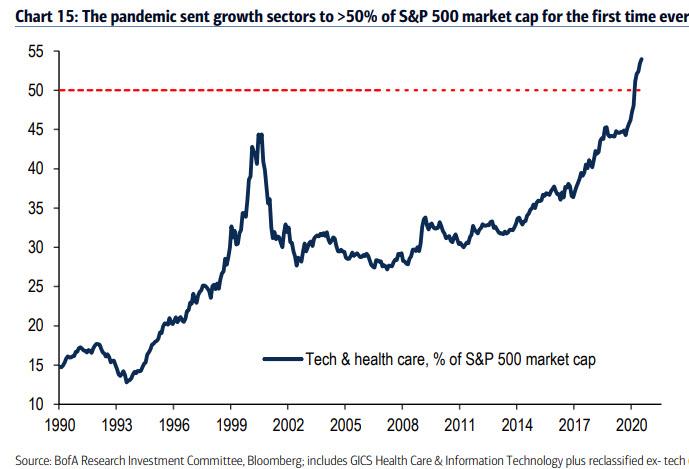

This unprecedented dependence on ever lower yields is why defensive growth stocks (tech & health care) now account for just 18% of US jobs but now comprise >54% of the S&P 500 market cap (and, if projected at the current pace, 100% by 2024).

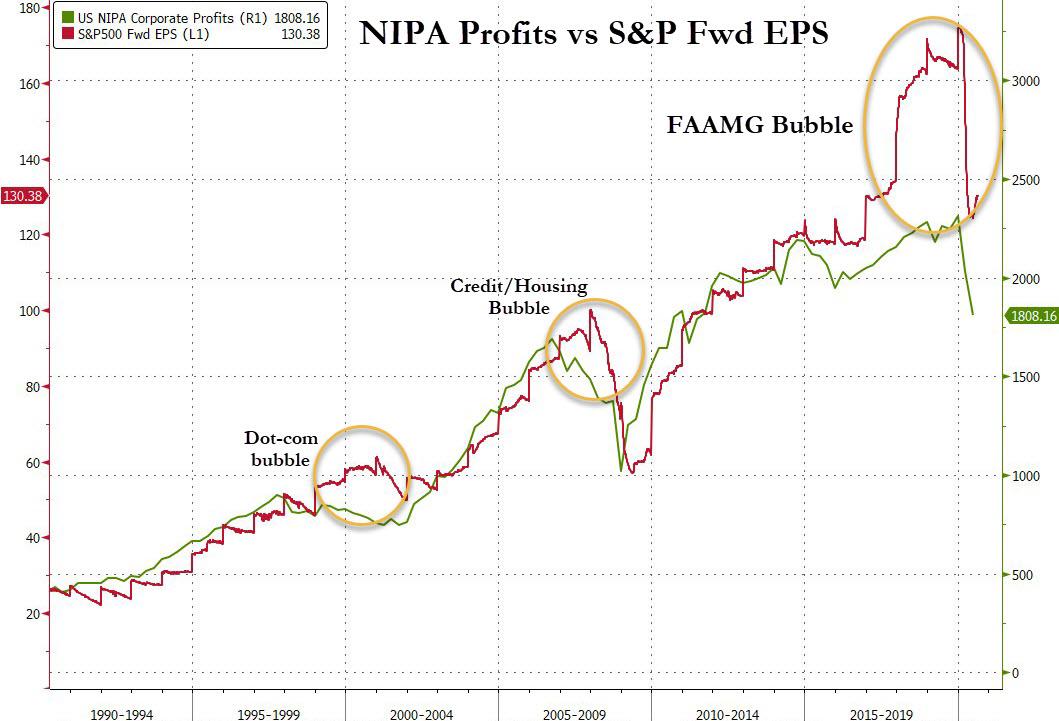

Meanwhile, the Fed keeps injecting more and more liquidity even as growth is scarcer and scarcer. As a result of this maximum liquidity in a world of scarce growth. the Fed has created an ever larger series of asset bubbles.

And when real interest rates are negative as they are now, there is every incentive to chase low-probability, high-impact upside according to Woodard. In short, any vehicle with a chance at large returns becomes a cheap call option.

Just two examples: in 2020 investors are once again pouring cash into “blank check” IPOs or Special Purpose Acquisition Companies, just as they did in the summer of 2007. As we first discussed several weeks ago, SPACs have no operations but simply raise funds for undetermined future acquisitions. At the same time, one bitcoin costs more than $11,000. That’s more than the average US household makes in two months.

Despite the asset bubbles observed virtually everywhere, BofA says that economic stagnation remains its base case: "more stimulus and early vaccines at best get us to the 2019 ante of low growth and precarious wages/EPS." A stagnant world also makes yields more valuable as interest rates everywhere trend toward zero. As such, today a record 79% of the S&P 500 offers dividends greater than the 10-year Treasury yield.

In summary, "stagnant GDP, deepening inequality, and the threat of policy failure make us bullish on the things we don’t want to buy (growth, large caps, US) and bearish on the things we want to own (value, small caps, EAFE) because, without an economic transformation, any reversal in the ranks of market winners & losers can only last a season."

* * *

Finally, speaking of things "nobody wants to buy but has to", and how "it's all one big trade", here is an excerpt from the latest Bear Trap report citing a west coast CIO on the recent surge in Tesla:

"Tesla is the key to this market, all are in Elon's world, I am ignoring everything else, rates, dollar, etc.. for now. They are truly minor in comparison until Tesla breaks. And vol is underpriced on the upside still in my mind. Tesla's run likely to end on a blow-off top, 100B volume, we are talking about a 300-400 dollar candle, no way this ends quietly, really think it ends with a flash crash in NDX. I still think October is badly mis-priced to the upside, TSLA can easily see 30% higher before it reverses. Puts are stupidly expensive if you go way out on the wing, you can sell a January $200 put for over 2 bucks, that's insane. Crypto is the only asset with more convexity than Tesla. Outside bitcoin, TSLA defines parabola in terms of company in the history of stocks with any meaningful market cap. My gut tells me Elon does a massive secondary into SPX add, like $30B. Tesla would come out with the world's best auto-balance sheet, on par with Toyota."

August 31, 2020 at 06:20AM

via ZeroHedge News https://ift.tt/3hNpbTa

Comments

Post a Comment