By Tyler Durden

Berman: Game Over For Oil... The Economy Is Next

It’s game-over for most of the U.S. oil industry.

Prices have collapsed and storage is nearly full. The only option for many producers is to shut in their wells. That means no income. Most have considerable debt so bankruptcy is next.

Peggy Noonan wrote in her column recently that “this is a never-before-seen level of national economic calamity; history doesn’t get bigger than this.” That is the superficial view.

Coronavirus has changed everything. The longer it lasts, the less the future will look anything like the past.

Most people, policy makers and economists are energy blind and cannot, therefore, fully grasp the gravity or the consequences of what is happening.

Energy is the economy and oil is the most important and productive portion of energy. U.S. oil consumption is at its lowest level since 1971 when production was only about 78% of what it was in 2019. As goes oil, so goes the economy…down.

The old oil industry and the old economy are gone. The energy mix that underlies the economy will be different now. Oil production and price are unlikely to regain late 2018 levels. Renewable sources will fall behind along with efforts to mitigate climate change.

It’s Really Bad

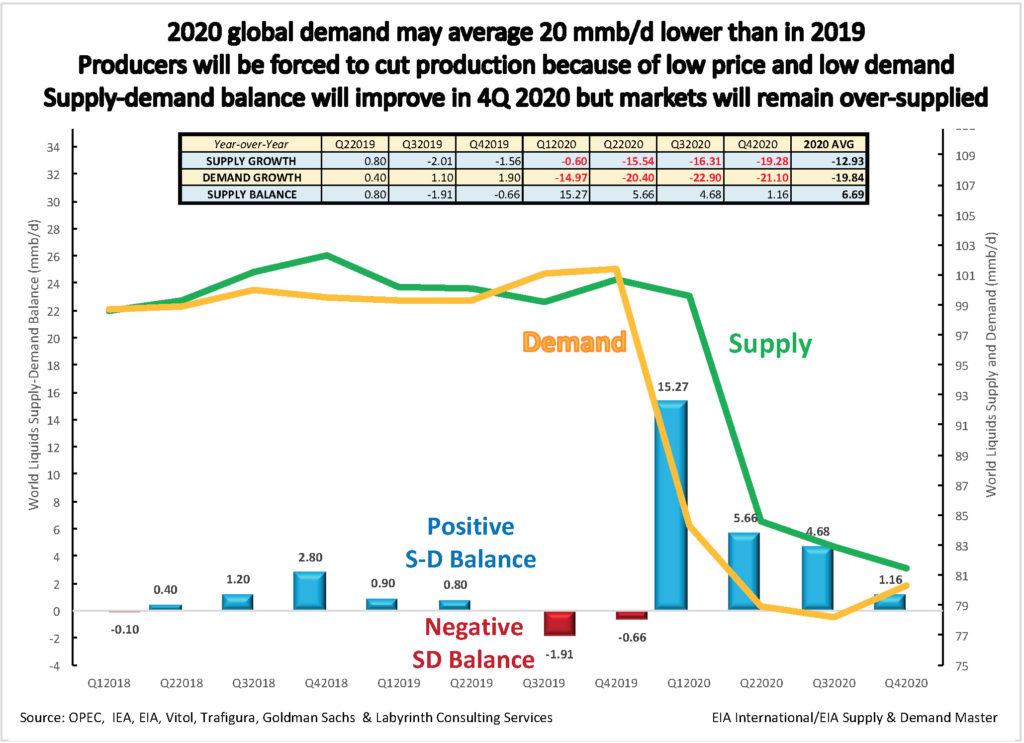

2020 global liquids demand may average 20 mmb/d less than in 2019 (Figure 1). This estimate is really a thought experiment because it is impossible to know what supply and demand are in the present much less in the next quarter or beyond. This is a time of unimaginable flux and uncertainty because no one knows how long economic activity will be depressed, how long it will take to recover or if it will recover.

The estimate in Figure 1 differs from most forecasts in two important ways. First, I believe that supply will fall much faster than most other sources. That is because storage will soon be full and shutting in production will be the only option for many producers.

Figure 1. 2020 global oil demand may average 20 million barrels per day lower than in 2019.

Source: OPEC, IEA, Vitol, Trafigura, Goldman Sachs and Labyrinth Consulting Services, Inc.

Second, I doubt that there will be a demand recovery in the third quarter despite the re-opening of businesses in the second. That is because we are in a global depression. Unemployment will remain high and consumers will be damaged from lack of income over the months of quarantine. The truth is that I doubt that demand will ever recover.

Economies will re-start slowly. A useful analogy is being at a traffic light behind 25 stopped cars. The light will change from green to red before your car begins to move. It may take several light changes before you get to the other side of the intersection.

U.S. consumption has fallen about 30% from 20 mmb/d in January to 14 mmb/d in April. Refinery intakes are already 25% lower than in the first quarter of the year and will fall further as consumption decreases. Refineries will close.

Most U.S. refineries require intermediate and heavy crude oil that must be imported. Few U.S. grades of oil can be used to produce diesel without blending them with imported oil. That is because they are too light to contain the organic compounds need to make diesel. Redesigning refineries will not change this.

The world’s natural resource extraction, shipping and distribution system relies on diesel. As refineries close and less diesel is produced, there will be lower levels of natural resource extraction, less manufacturing and less buying of goods.

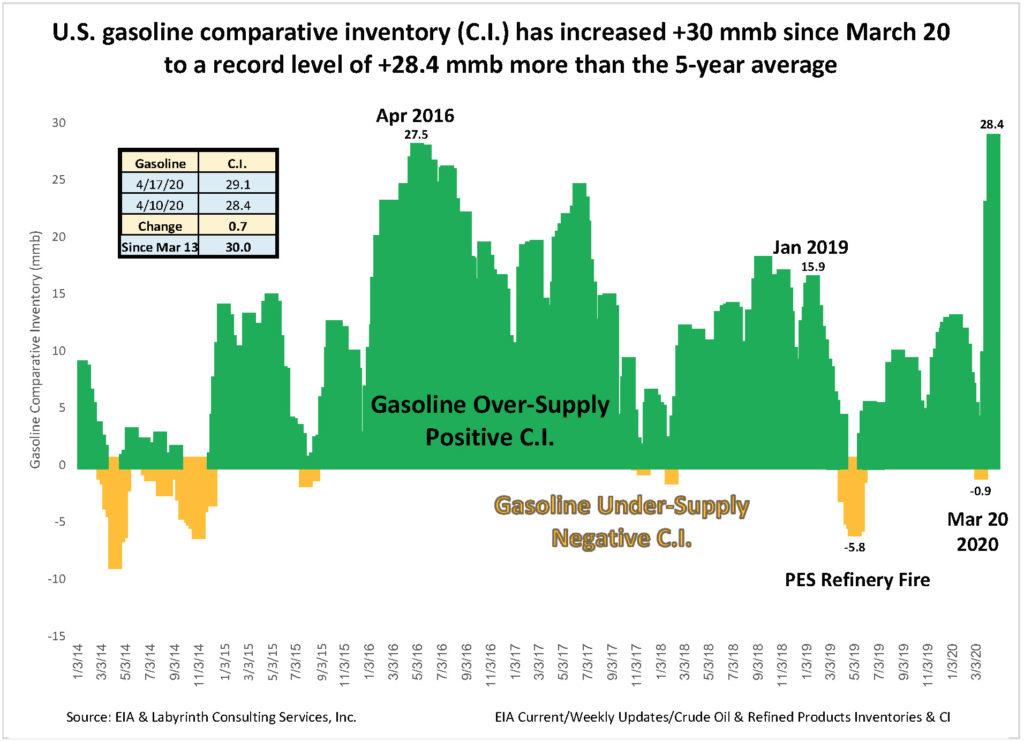

Diesel cannot be produced without first producing gasoline. The U.S. has had a gasoline surplus since late 2014 and the current surplus is the highest in 5 years (Figure 2).

Figure 2. U.S. gasoline comparative inventory has increased 30 million barrels since March 20 to a record level of 28.4 million barrels more than the five-year average. Source: EIA and Labyrinth Consulting Services, Inc.

Diesel demand is less elastic than gasoline demand because of its critical role in heavy transport. What will happen to the excess produced gasoline if storage is full? Will it be burned?

Those who see an opportunity for renewable energy in the demise of oil need to think again. The manufacture of solar panels, wind turbines and electric cars depend on diesel all along the supply chain from extraction to distribution of finished products. A world in economic depression will default to the cheapest and most productive fuels. Oil will be cheap and abundant for a long time. There will be little money or appetite for the massive equipment changes that renewable sources require. Climate change will not be high in the consciousness of people struggling to survive.

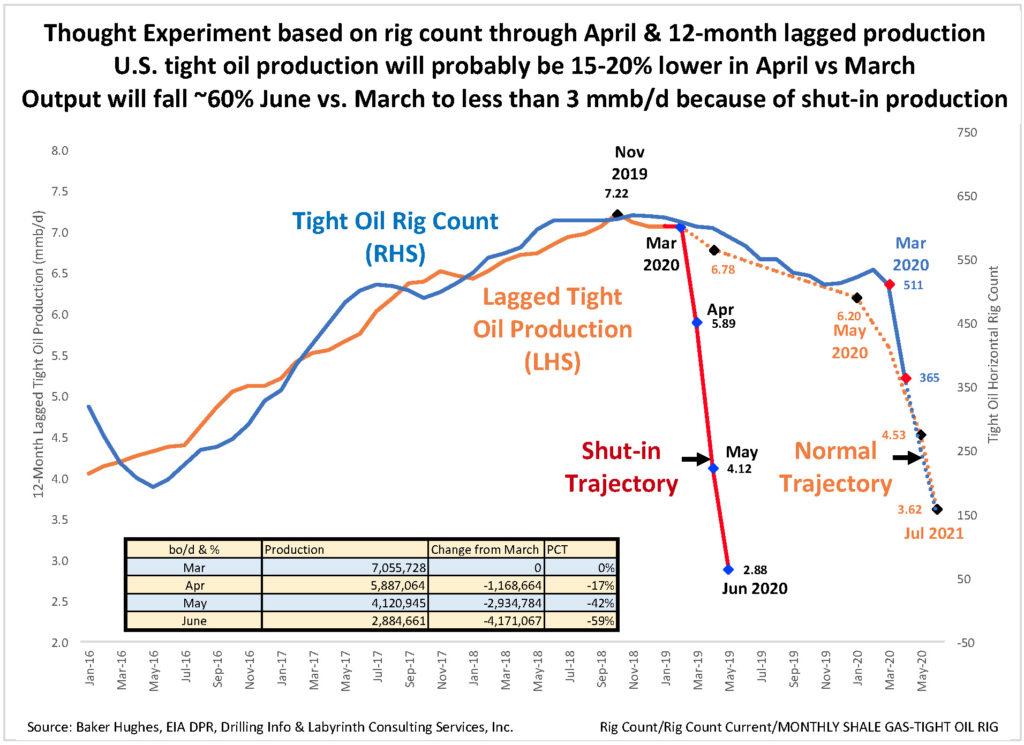

Figure 3 is another thought experiment in which I use tight oil rig count and output to estimate forward levels of U.S. production. The normal trajectory is an estimate of how production might decline as rigs are idled from lack of capital investment. It suggests that tight oil production might decrease by about 50% from 7 to 3.5 mmb/d by July 2021.

Figure 3. Thought experiment based on rig count through April 2020 and 12-month lagged production.

Source: Baker Hughes, EIA DPR, Drilling Info and Labyrinth Consulting Services, Inc.

The shut-in trajectory suggests that tight oil production may fall below 3 mmb/d by June of this year. Since tight oil accounts for about 55% of U.S. output, total crude oil and condensate production could decline from 12 mmb/d to 5.5 mmb/d by the end of the first half of 2020. This estimate is much more aggressive than EIA forecasts because EIA hasn’t adequately modeled the speed of shut in production with full storage levels.

Energy is the Economy

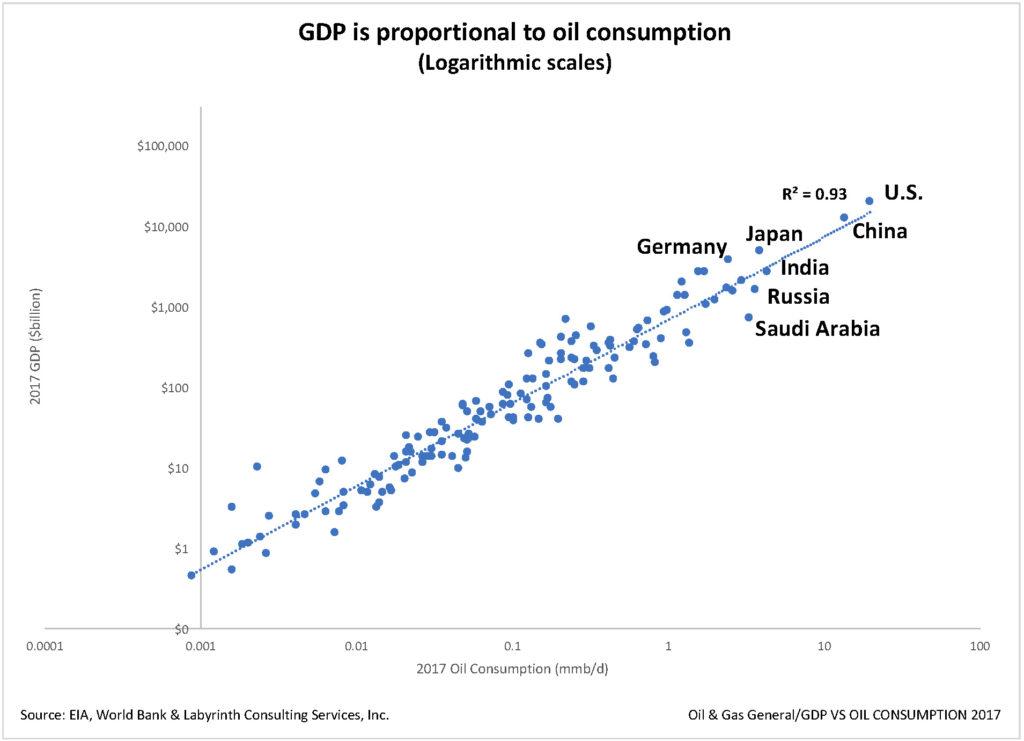

Gross domestic product (GDP) is proportional to oil consumption (Figure 4). That’s because oil is the economy. Every aspect of production and use of goods and services requires burning fossil energy. There are approximately 4.5 years of human labor in a barrel of oil (N. J. Hagens, personal communication and The Oil Drum). No other energy source comes close to that level of energy density.

Figure 4. Gross domestic product (GDP) is proportional to oil consumption

Source: EIA, World Bank and Labyrinth Consulting Services, Inc.

Those who believe that the world will function the same on lower energy density sources like wind and solar should review their old physics text books. You cannot fit 4.5 years of work from sunlight or wind into the 5.6 cubic feet space of a barrel of oil.

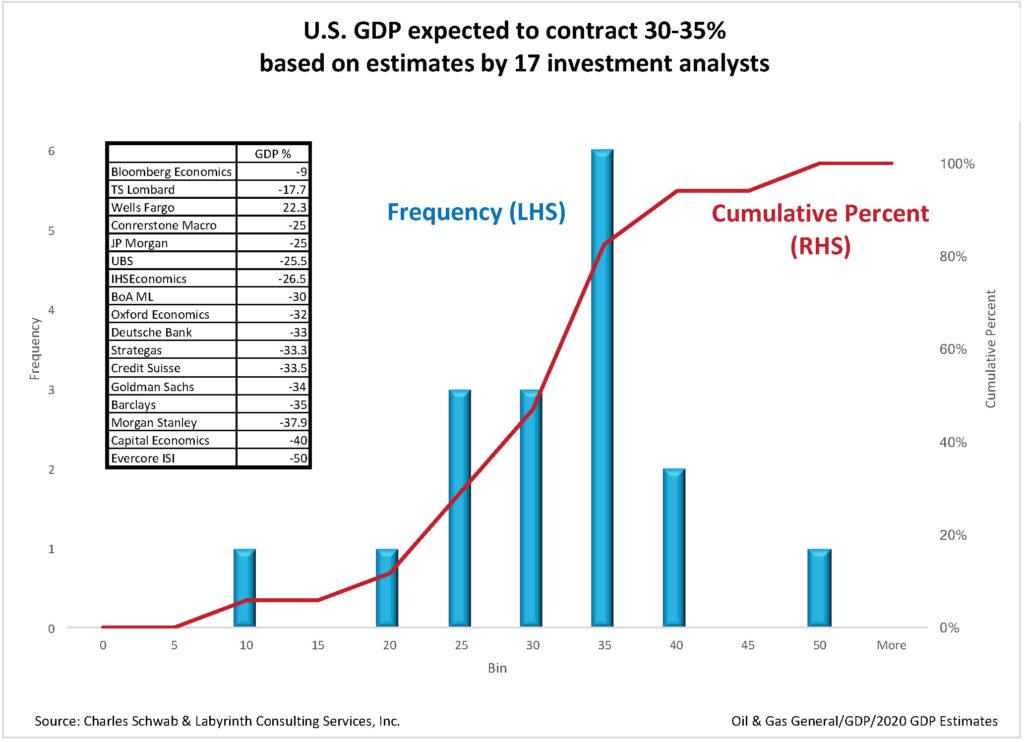

Seventeen investment analysts recently estimated that U.S. GDP would contract an average of 30-35% in 2020 (Figure 5) within a range of 9-50%. The correlation shown in Figure 4 suggests it will decrease by about 20-25% based on estimated decrease in U.S. oil consumption. Any value within this spectrum is catastrophic.

Figure 5. U.S. GDP to contract 30-35% in 2020 based on estimates by seventeen investment analysts

Source: Charles Schwab and Labyrinth Consulting Services, Inc.

Economist Lawrence Summers has warned that the U.S. financial system may collapse because of cascading defaults. Approximately 25% of U.S. renters did not pay their landlords and 23% of Americans did not make their mortgage payment in April. When people don’t pay their creditors, creditors in turn cannot pay their creditors. For comparison, a 28% mortgage default rate contributed to the 2008 financial collapse.

Joseph Stiglitz recently explained that the current pandemic will affect the developing world more severely than it has developed countries. It might lead to mass migration problems that could dwarf the dislocations of the last six years out of Africa and the Middle East.

Slouching Toward Bethlehem

Many will probably find my analysis overly pessimistic. Crude oil markets do not. Negative WTI futures prices last week could not have sent a stronger signal for producers to cease and desist.

Large segments of the U.S. oil industry will have to be nationalized before the year is over. The price of oil is too low to justify the cost of extraction even if storage were available. The value of a barrel of oil, however, is 4.5 man-years of work and that productivity multiplier will be essential if the U.S. economy is to avoid collapse or for it to recover if collapse is unavoidable.

The United States has engaged in the foolish practice of draining America first since the beginning of tight oil production a decade ago. There was value up to the point that domestic oil substituted for imported light oil but exporting more was dumb. That is true especially now that someone else’s oil will be cheap to buy for years.

There are few moments when we may truly say that things are different now. This is one of those moments. We do not know what awful form the future may take, what rough beast slouches toward Bethlehem to be born.

The game is over for oil. We should place all of our attention on saving the economy.

I hope that we learn to view what is happening as a chance to simplify and to learn to be satisfied with no more than what we need. It is unlikely that we will have much choice.

May 1, 2020 at 05:50AM

via ZeroHedge News https://ift.tt/2VPGJWi

Comments

Post a Comment