By Tyler Durden

Bank Of America: "Nowhere To Hide"

It's not just the markets that are in freefall, so are crushed revised estimates of global economic growth.

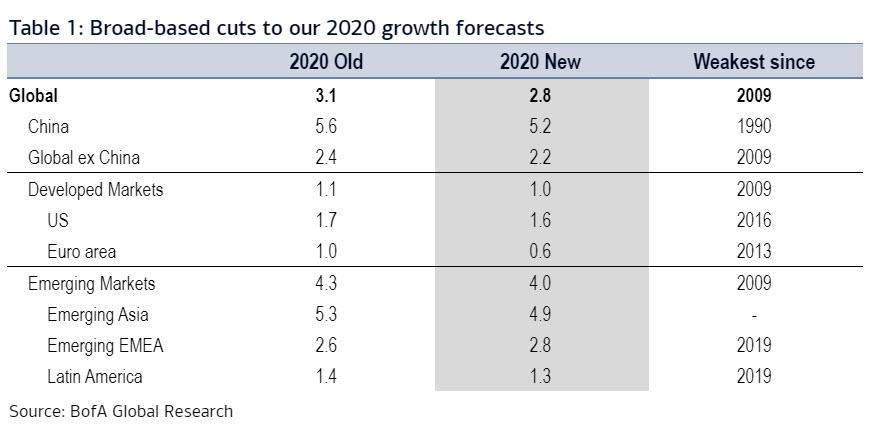

Overnight Bank of America has taken the axe to its GDP growth forecasts, and in a note titled "Nowhere to Hide", the bank's chief economist Ethan Harris, writes that "we have taken another slice out of our 2020 global GDP forecast. The downward revisions are broad based, and we now expect just 2.8% global growth this year (Table 1). This would be the first sub-3% print since the financial crisis."

Explaining why it's "Gloom but not doom", Harris writes that last month he cut his 2020 China growth forecast from 5.8% to 5.6%, "but left other major economies unchanged on the expectation of a brief and contained disruption. Our previous base case now looks increasingly like a best-case scenario." However, with the V-shaped recovery no longer looking realistic, BofA's new forecasts "account for a more "U-shaped" growth recovery, and a greater permanent loss in output."

Explaining further, BofA writes that the weakness in the global economy is being driven by three factors.

- The first is the lack of momentum going into the year. When we published our year-ahead report last November, we were calling for just 3.2% global growth, which was already well below trend, in our view. Since then 4Q GDP came in even weaker than expected, suggesting that trade and tech war uncertainty remained a headwind for global growth.

- The second factor, of course, is China's aggressive response to the COVID-19 outbreak. Economic disruptions have lasted for more than a month and many migrant workers are yet to return to work, leaving factories unable to operate at full capacity. As a result we have cut our China forecast again. We expect roughly zero sequential growth in 1Q, and a more delayed recovery, pushing 2020 growth down to 5.2%.

- Last, we are now looking for large spillover effects. Extended disruptions in China should hurt global supply chains. Weak tourist flows will be another headwind for Asia. And limited outbreaks, similar to the one in Italy, are possible in many countries, leading to more quarantines and weighing on confidence. Therefore we have cut our forecasts across the board. We project just 2.2% growth outside China, also the lowest rate since 2009.

Not surprisingly, Harris cautions that "while the distribution of risks around our forecasts is now more balanced, we think the risks are still skewed to the downside." The reason for that, is that his forecasts "do not incorporate a global pandemic that would basically shut down economic activity in many major cities. Accordingly, we are also not calling for a global recession (i.e., sub-2% global growth)." In other words, BofA's global recession forecast will depend on whether China can reboot its economy, something it has been scrambling to do by fabricating low infection numbers and manipulating its Coronavirus statistics.

The risk, of course, is that in its panicked scramble to restart the economy, Beijing launches a second wave of infections, destroys what little confidence the people have in the communist party, and terminally cripples its - and the global - economy.

February 28, 2020 at 07:55AM

via ZeroHedge News https://ift.tt/2VtF4G8

Comments

Post a Comment